Our latest stories

.jpg)

CEE Tech M&A 2026 Outlook: A Turning Point? Trends and Insights for Founders and Investors Preparing for an Exit

In this article we have analysed a thorough combination of

- qualitative data from Absolvo’s own discussions with major global and regional strategic buyers and private equity funds (as part of our regular calls with them), including investors from the US, Europe or even from Singapore,

- latest market data and macro trends translated to the CEE tech ecosystem

With these global trend analysis and real buyer quotes we aim to paint a picture of what founders and VCs should expect going into 2026.

What we can conclude: though uncertainty is not disappearing, stabilising macro indicators, renewed buyer appetite, and a significant amount of dry powder position 2026 as one of the strongest exit years of the decade. All these paired with resilient tech valuations and growing investor interest in Central and Eastern Europe, our 2026 CEE Tech M&A Outlook points to a turning point where both strategic and PE investors will be ready to buy: strategics will pursue assets with clear strategic fit, while Private Equity will focus on targets that qualify as a platform or unlock add-on consolidation opportunities within their thesis.

However, they don’t chase hype (therefore are cautiously analysing the real value behind AI or other similarly favoured industries) and some of them have just recently discovered the potential in the CEE tech landscape. In the second half of the article we have even collected some hands-on advice for both founders or VC fund managers that are planning an exit for the next 6-18 months.

1. Uncertainty is here to stay

Over the past three years, the M&A market faced a perfect storm: inflation spikes, interest rate uncertainty, volatile valuations, and geopolitical noise (war in Ukraine, tariff wars, political turbulence, etc.). This was no different in H1 2025: global M&A volume was 9% lower YoY, but value rose by 15% YoY, reflecting a shift toward megadeals, meaning the market remained selective, with investors concentrating capital into fewer, high-conviction transactions rather than spreading risk across smaller deals.

If you have been part of a transaction in the past 24 months, you certainly experienced that deal-making is slower, due diligence is more thorough, which has slowed processes but increased seriousness and quality of intent. Also, cautious buyers rarely pay a premium without real fundamentals and strong reasoning. In a recalibrated market, valuation discipline dominates: global median M&A EV/EBITDA multiples stood at ~9.3x in mid-2025 as of June 2025, while European PE deals averaged ~11.2x, compared to ~8.5x for corporate buyers.

Macro conditions seem to stabilize inflation and base rates have normalised, financing is more predictable, but what we have had to learn since 2021 is to expect that there will be something unexpected in the macroeconomic trends, which means this has to be part of our strategy (both on the sell- and the buy-side). In other words: "uncertainty is no more a bug, it is a feature”.

2. Dry powder needs to be deployed, investors’ appetite needs to be fed

With global PE dry powder estimated at over USD 2.5 trillion, capital sitting idle is no longer neutral. Uninvested capital creates opportunity cost, IRR pressure and growing LP expectations - all of which translate into increased deal appetite, even in a selective environment. Many investors, especially in the US paused or reconsidered deals in early 2025, but these will be missing from product portfolios, books and revenues and strategies in general.

In practice, this means that while buyers remain cautious, they cannot stay on the sidelines indefinitely. Capital needs to be deployed - and hungry investors need to be fed. Deloitte’s most recent M&A outlook shows that around 90% of PE dealmakers expect M&A activity to increase over the next 12 months, with a similar majority anticipating higher deal values. Confidence is returning - cautiously, but decisively.

In uncertain times, buyers are very selective - but to be honest, good and successful investors have always been so. Companies with healthy strategic and financial fundamentals and strong future potential keep being acquired and sold. Strategic buyers primarily look at potential strategic fit – we will explore this in more detail later. On the other hand, a typical PE is first looking at metrics like topline growth, retention, LTV/CAC, etc. For them, a deep insight into company metrics is a MUST. Apart from metrics, there has to be a clear technological advantage and/or a focus on a niche segment. As one major global PE investment firm told Absolvo “We prefer tech-led advantage and need to see a clear differentiator in every case we seriously investigate”.

3. Tech M&A: Outperforming the market

The technology sector continues to be among the most attractive sectors for M&A activity, both in Europe and globally: Tech M&A in 2024 ended the year strong, well outpacing the overall M&A market’s 10% growth in 2024 with 32% growth in deal values.

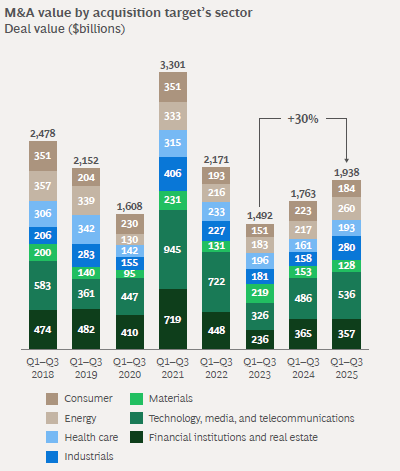

According to BCG’s M&A Report of the first 9 months of 2025 overall global M&A activity experienced a 10% YoY growth, with the TMT sector leading in deal volume ($536 billion). If we look at valuations, one study shows that the IT sector clearly outperforms the market with an average of 13,2x EV/EBITDA multiple (vs. 9,3x across all sectors).

In 2026 tech remains attractive among Private Equity firms, too, it is the No 2. domain for PE investors following life sciences and health care. 74% of survey participants for Mergermarket expect to invest in technology, which is the second most popular industry after life sciences (including healthcare).

Within niche tech segments, cybersecurity, vertical SaaS, AI-enablement and data infrastructure continue to attract disproportionate interest. In Europe, mega-deals have driven much of the recent growth - proof that strategics and PEs are ready to bet big again. 2025 has seen $1B+ cybersecurity roll-ups and vertical SaaS/IT services mergers in Europe, with CEE also part of the wave as SaaS M&A activity surged 28% YoY, on pace to become the most active year ever.

However, in case the motivation is not purely based on missing pieces of the product portfolio, investors are in love with the sticky, ‘boring-but-beautiful’ software categories (ERP, HR, payroll, invoicing, inventory management, etc.). An emerging group of investors, the so-called software consolidators’ follow a special buy-build-hold philosophy, reinvesting in operations and bolt-ons to drive long-term value rather than exit timing.

Therefore they typically acquire companies with sticky mission-critical software, high retention and strong lifetime value - assets where users are reluctant to churn and where future cash flows are more predictable and defendable. Global and regional consolidators such as Jonas Software and Vesta Software Group are already actively investing in CEE, closing transactions, while some others like Shop Circle or the Publix Group have recently put this part of Europe on their potential target list, but certainly more activity can be expected from this segment.

AI is hot, but both strategics and PE investors filter out AI “storytelling” and overclaiming. During our end-of-year discussions, investors confirmed to the Absolvo team that they are only interested in companies that have built and shipped real AI projects, with evidence of customer adoption and satisfaction. Especially those coming from the tech sector themselves, have been part of AI-related developments. As a strategic investor in ERP systems put it: “we see AI as evolution, not revolution”

At the same time, regulatory frameworks such as the EU AI Act, DMA and DSA are increasing scrutiny during due diligence. IP ownership, data governance, cybersecurity and compliance readiness have become core diligence topics, reinforcing the need for substance over hype.

In many cases AI investments are still driven by the FOMO affect, with nice engagement metrics, but unproven business models. Therefore, it is not for everyone. The above mentioned vertical software integrators have a specific view: as they are primarily looking for predictable recurring revenues, EBITDA-positive and preferably local / regional market leaders, they rarely engage with purely AI-driven businesses and will wait out until this niche is ready for consolidation.

However, AI is becoming a horizontal aspect of investments, too. Talking with global leading European PE firms like Permira or EQT, they all emphasized that in B2B software, “no AI thesis = no deal” is becoming the norm. As one of them put: “…anything we consider nowadays, there has to be an AI thesis around that”

4. CEE is an underexplored but increasingly attractive opportunity

Regarding tech deals, Central and Eastern Europe is playing its own role: as we have experienced in other parts of the world, the sector witnessed high-value deals in Q4 2024, led by strategic buyers focusing on digital growth, altogether there was a decline in deal volume, but a substantial increase (424%!!!) in value. Apart from the mega deals, mainly add-on acquisitions dominate. This is classic PE behaviour: using strong regional engineering talent and attractive price points to fuel platform growth.

For many funds and strategics, CEE is turning into an underexplored opportunity rather than a “nice-to-have.” Some global strategic acquirers have repeatedly admitted to Absolvo that they historically overlooked the region - but rising valuations in Western Europe and the US are pushing them to broaden their horizon. “We know little about CEE, but we have recently turned toward the region.” said an M&A director of a major European B2B software developer company specialising in ERP, accounting and business management solutions.

If we look at specific verticals and buyers in niche segments like Palo Alto Networks or Encora in cyber security, their primary geo focus is elsewhere, mainly US and Western Europe. But if a certain technology fits their portfolio, let alone it is the missing piece or there is an interesting innovative element, they can be a relevant target. CEE is often perceived as a region of outstanding engineering and strong technology foundations - a compelling starting point, but rarely a deal thesis on its own.

The winning narrative builds on that base with a scalable product, proven execution, and/or a platform opportunity in a fragmented market, where consolidation is structurally embedded for companies that are born regional - or ideally born global.

5. How to prepare for 2026 (and beyond)

High importance on being strategic fit

During our end-of-the-year discussion with appr. 50 strategic investors and Private Equity firms, one of the key points were to identify how they look at a potential opportunity. What has been undoubtedly common in all strategic buyer talks was – no surprise - that strategic match is THE key!!!

This means business (sales, marketing) and product strategy alignment between buyers and sellers. Acquirers can have multiple motivations, from market expansion goals through diversification to cost savings - understanding this and clearly demonstrating how a target can accelerate those objectives is often one of the most decisive value drivers - in such cases, buyers are willing to pay even 2-3 times above fair market value.

Additionally, if a product can scale independently or integrate seamlessly into the acquirer’s portfolio, that flexibility means strategic value and opens up various post-acquisition scenarios. For exceptional CEE tech companies with great products and solutions, a larger strategic player with existing regional or global sales-marketing channels can be a real upside, opening endless opportunities.

As one M&A director put it:

“When strategic fit is clear and the product or talent is globally competitive, valuation becomes secondary - and geography irrelevant.”

In another discussions similarly, the hierarchy of criteria was revealed: Strategic synergies first; then strong management, good client base, scalability of the product / service – and valuation last.

Private Equity funds remain bullish - 2026 could be the breakout

Several major PE investors confirmed strong activity in 2025 and rising expectations for 2026. PE is gearing up for significant dealmaking - and CEE is more often on the consideration list. However, strong metrics and transparency are non-negotiable. For platform investments retention, gross margin, LTV/CAC, 30%+ growth - these are now the first filter, not the last. Regional VCs like Genesis, CEECat and European/global players like Hg Capital or Permira all emphasized the importance of strong marketing and go-to-market execution capabilities – a feature that is one of the key challenges of CEE-rooted scaleups.

For those planning an exit - or aiming to continue growing as a regional champion, potentially through inorganic expansion - 2026 may offer a particularly attractive window for transactions. Improving market conditions, active buyers and growing deployment pressure are creating promising opportunities. Regional VCs should evaluate their portfolios now: Which companies are strategically attractive? How prepared are their portfolio companies for a potential acquisition? Is exit preparation part of the overall strategy and is it in line with further product development plans? Optimization and preparation takes time, often 2-3 years, so it has to be started ASAP.

For those companies, where a transaction is still further out, this period provides valuable time to prepare. Exit readiness is rarely a short process; it often takes two to three years. Understanding your buyer universe within your sector, identifying potential strategic synergies, and embedding these insights into your long-term strategy can bring 2-3-5x of fair market value when the window opens.

All in all, if you plan a transaction in the next 2-3 years, you need to prepare ASAP. If you are interested in:

- how prepared you are for a strategic exit or a PE transaction?

- what are the fair multiples in your market?

- and how preparation can help you increase a potential exit value?

Feel free to reach out to the Absolvo Team for a consultation. We wish you clarity, discipline and momentum in the year ahead!

The analysis combines qualitative data coming from investor interviews conducted by Absolvo and industry benchmarks plus market data from sources including (but not limited to) PitchBook, Mergermarket, Sifted, Goldman Sachs, EY, Bain&Company, Deloitte and PwC.

Venture Capital in general and in CEE – Key Insights for Businesses that want to boost their growth with fresh funding (Part 1)

While venture capital offers opportunities to accelerate expansion, growth, the process of securing VC investment is complex. It requires an understanding of investor expectations, proper planning of strategy and financials; detailed term sheet and investment agreement negotiations.

Venture capital (VC) is an equity-based financing method, typically used by businesses with high growth potential in specific phases of their lifecycle—particularly in early and growth stages.

The financing needs and options for companies vary significantly depending on whether they are in an early- or a more mature growth phase.

Early-stage businesses require different types of funding compared to well-established companies. As businesses mature, other financing sources often take precedence, such as private equity, strategic investors, or stock market listings. Each stage comes with unique challenges, tasks, risk factors, and growth objectives.

In both regional and international practice, venture capital investors (those who you meet are GPs, or general partners) are managing venture capital funds. These funds are financed by institutional investors (e.g. banks, international financial organizations, investment funds, insurers) and high-net-worth individuals – they are the LPs or limited partners.

A CEE regional characteristic is that funds rely heavily on government or EU resources, which influence both the available investment opportunities and the applicable rules.

Venture capital investors primarily target companies (startups) with exceptional talent and growth potential, often at early stages, but with higher risks. They invest in partnership with the founders in exchange for equity (shares, stakes), becoming co-owners of your business, so this is not a loan or grant!

In return for taking higher risks, venture capital investors expect above-average returns. Depending on the fund manager, they typically aim for a return on investment of 3-10-times. For example, if they invest €1 million, they expect to receive €3–5–10 million in return.

Venture capital investors typically invest for a period of 4–5 years, after which they exit the investment by selling their stake. This exit can occur in various ways: they may sell their shares back to the founders or existing owners (more common with state-backed funds), but most often, they sell to a third party, typically a strategic investor (trade sale) or another financial investor, such as private equity funds.

The return on the investment is realized at the time of exit—when the company is sold—so there is no requirement to pay monthly or annual interest or principal. Venture capitalists aim to achieve their return during the exit phase and are, therefore, motivated to drive significant value creation and company growth in the meantime.

The Risk-Reward Dynamic of Venture Capital Funds

Companies that raise venture capital are referred to as portfolio companies, as funds typically manage multiple investments simultaneously, forming a portfolio. As being financial investors, their primary goal—and the expectation of their investors—is to manage the overall portfolio’s returns while mitigating risks at the portfolio level.

Some portfolio companies may only partially achieve the expected return by the end of the investment period, or not at all, while others may exceed expectations, achieving significant growth and a successful exit. These high-performing companies can offset the underperforming or failed investments.

VCs know not every investment will make returns, and some may even result in losses. This risk-reward dynamic explains why

venture capitalists seek such high returns on each deal. While they typically do not involve themselves in daily operations, they actively engage in strategic and major financial decisions affecting the business and its profitability (e.g. loan decisions, large CAPEX items etc.).

Fund managers are inherently interested in supporting the growth of portfolio companies, as their personal return (through so-called carry) is connected to the exit value which depends on how much the company has grown.

Venture Capital and Other Equity Financing Options by Growth Stage

Once the need for capital raise is identified, the most critical step is to clarify the type of investor that fits—which depends on the current growth stage of the business and the goals it seeks to achieve with investment.

Depending on whether your business is in its early stages or a more mature phase, it’s important to approach the most suitable type of investor. Across the CEE region, there are numerous opportunities for companies with innovative business solutions, unfair competitive advantages, and strong market potential to secure fresh capital for growth, expansion, and transitioning to the next stage of maturity.

Matching your expected results and objectives with the right investor pool is a critical step in the capital raising process.

Businesses at different maturity stages can access the following primary types of equity financing sources:

- Early-stage companies can secure funding from angel investors or seed-stage VCs, typically in the range of EUR 50,000–300,000 in the CEE region. Some seed or late-seed deals nowadays are rather in EUR 1-3 million range.

- Growth-stage companies operating in innovative sectors, with developed products that are already on the market, proven market feedback, and significant international revenues, can consider growth capital investments from venture capital funds. These investments range in the CEE from EUR 4–10 million. You’ll see “Series A / B / C” rounds, referring to the first, second etc rounds and possible share class.

- Well-established companies, even in traditional industries, that are operating successfully with revenues in the ten. millions of EUR, a strong market position, and generating significant EBITDA, may require external capital to accelerate growth and expansion, acquire other players or competitors, restructure debt, buy out a co-owner, or improve operations. These companies are typically suited for private equity funds or, in specific cases, turnaround funds.

- Buyouts are usually executed by strategic investors or private equity funds, though fresh capital in the form of equity injections is also an option, from even EUR 1-5 million, however a typical CEE PE fund will look for deals above 10-20 million.

Venture Capital or Bank Loans?

For more mature businesses with several years of operational history and historical performance data, bank loans can be a viable solution for financing investment plans, provided they can offer sufficient collateral. However, for early-stage companies with limited collateral and seeking financing several times their revenue to support growth, scaling, or international expansion, venture capital may be a more viable option.

Venture capital is a specialized form of financing where bank loans are not really alternatives.

Key Differences Between Venture Capital and Bank Loans

- Repayment structure: One of the most significant differences is the repayment method. Bank loans require fixed repayments with interest, typically sourced from the company’s cash flow, regardless of its profitability or success. Venture capital investors, by contrast, realize their return at the end of the 3–5-year investment period during the exit phase. This means no cash is drained from the company for repayment during the investment period.

- Ownership approach: Unlike lenders, venture capital investors view themselves as co-owners and business partners, committed to driving the company’s growth. Banks, on the other hand, are not invested in the company’s success and do not participate (nor have the expertise to participate) in its operations.

- Added value: Venture capital can provide significant momentum for a company, as investors often contribute more than just capital. They can offer industry knowledge, strategic guidance, and access to networks (known as "smart money") to help the company achieve higher value creation and return on investment.

Types, Key Characteristics, and Volume of Venture Capital and Private Equity Investments

The types, main characteristics, objectives, and volumes of venture capital and private equity investments can be summarized as follows:

What’s next?

How can you identify the potential investors to approach in the first round? How many can you negotiate with parallel? How will you learn about the investors’ backgrounds and preferences before your first meeting? What advantages and synergies can you present to them?