Results for: “

M&A

“

.jpg)

CEE Tech M&A 2026 Outlook: A Turning Point? Trends and Insights for Founders and Investors Preparing for an Exit

In this article we have analysed a thorough combination of

- qualitative data from Absolvo’s own discussions with major global and regional strategic buyers and private equity funds (as part of our regular calls with them), including investors from the US, Europe or even from Singapore,

- latest market data and macro trends translated to the CEE tech ecosystem

With these global trend analysis and real buyer quotes we aim to paint a picture of what founders and VCs should expect going into 2026.

What we can conclude: though uncertainty is not disappearing, stabilising macro indicators, renewed buyer appetite, and a significant amount of dry powder position 2026 as one of the strongest exit years of the decade. All these paired with resilient tech valuations and growing investor interest in Central and Eastern Europe, our 2026 CEE Tech M&A Outlook points to a turning point where both strategic and PE investors will be ready to buy: strategics will pursue assets with clear strategic fit, while Private Equity will focus on targets that qualify as a platform or unlock add-on consolidation opportunities within their thesis.

However, they don’t chase hype (therefore are cautiously analysing the real value behind AI or other similarly favoured industries) and some of them have just recently discovered the potential in the CEE tech landscape. In the second half of the article we have even collected some hands-on advice for both founders or VC fund managers that are planning an exit for the next 6-18 months.

1. Uncertainty is here to stay

Over the past three years, the M&A market faced a perfect storm: inflation spikes, interest rate uncertainty, volatile valuations, and geopolitical noise (war in Ukraine, tariff wars, political turbulence, etc.). This was no different in H1 2025: global M&A volume was 9% lower YoY, but value rose by 15% YoY, reflecting a shift toward megadeals, meaning the market remained selective, with investors concentrating capital into fewer, high-conviction transactions rather than spreading risk across smaller deals.

If you have been part of a transaction in the past 24 months, you certainly experienced that deal-making is slower, due diligence is more thorough, which has slowed processes but increased seriousness and quality of intent. Also, cautious buyers rarely pay a premium without real fundamentals and strong reasoning. In a recalibrated market, valuation discipline dominates: global median M&A EV/EBITDA multiples stood at ~9.3x in mid-2025 as of June 2025, while European PE deals averaged ~11.2x, compared to ~8.5x for corporate buyers.

Macro conditions seem to stabilize inflation and base rates have normalised, financing is more predictable, but what we have had to learn since 2021 is to expect that there will be something unexpected in the macroeconomic trends, which means this has to be part of our strategy (both on the sell- and the buy-side). In other words: "uncertainty is no more a bug, it is a feature”.

2. Dry powder needs to be deployed, investors’ appetite needs to be fed

With global PE dry powder estimated at over USD 2.5 trillion, capital sitting idle is no longer neutral. Uninvested capital creates opportunity cost, IRR pressure and growing LP expectations - all of which translate into increased deal appetite, even in a selective environment. Many investors, especially in the US paused or reconsidered deals in early 2025, but these will be missing from product portfolios, books and revenues and strategies in general.

In practice, this means that while buyers remain cautious, they cannot stay on the sidelines indefinitely. Capital needs to be deployed - and hungry investors need to be fed. Deloitte’s most recent M&A outlook shows that around 90% of PE dealmakers expect M&A activity to increase over the next 12 months, with a similar majority anticipating higher deal values. Confidence is returning - cautiously, but decisively.

In uncertain times, buyers are very selective - but to be honest, good and successful investors have always been so. Companies with healthy strategic and financial fundamentals and strong future potential keep being acquired and sold. Strategic buyers primarily look at potential strategic fit – we will explore this in more detail later. On the other hand, a typical PE is first looking at metrics like topline growth, retention, LTV/CAC, etc. For them, a deep insight into company metrics is a MUST. Apart from metrics, there has to be a clear technological advantage and/or a focus on a niche segment. As one major global PE investment firm told Absolvo “We prefer tech-led advantage and need to see a clear differentiator in every case we seriously investigate”.

3. Tech M&A: Outperforming the market

The technology sector continues to be among the most attractive sectors for M&A activity, both in Europe and globally: Tech M&A in 2024 ended the year strong, well outpacing the overall M&A market’s 10% growth in 2024 with 32% growth in deal values.

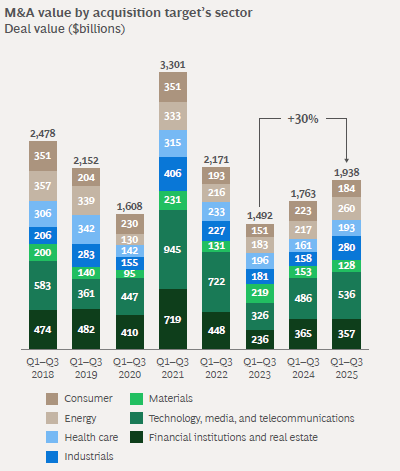

According to BCG’s M&A Report of the first 9 months of 2025 overall global M&A activity experienced a 10% YoY growth, with the TMT sector leading in deal volume ($536 billion). If we look at valuations, one study shows that the IT sector clearly outperforms the market with an average of 13,2x EV/EBITDA multiple (vs. 9,3x across all sectors).

In 2026 tech remains attractive among Private Equity firms, too, it is the No 2. domain for PE investors following life sciences and health care. 74% of survey participants for Mergermarket expect to invest in technology, which is the second most popular industry after life sciences (including healthcare).

Within niche tech segments, cybersecurity, vertical SaaS, AI-enablement and data infrastructure continue to attract disproportionate interest. In Europe, mega-deals have driven much of the recent growth - proof that strategics and PEs are ready to bet big again. 2025 has seen $1B+ cybersecurity roll-ups and vertical SaaS/IT services mergers in Europe, with CEE also part of the wave as SaaS M&A activity surged 28% YoY, on pace to become the most active year ever.

However, in case the motivation is not purely based on missing pieces of the product portfolio, investors are in love with the sticky, ‘boring-but-beautiful’ software categories (ERP, HR, payroll, invoicing, inventory management, etc.). An emerging group of investors, the so-called software consolidators’ follow a special buy-build-hold philosophy, reinvesting in operations and bolt-ons to drive long-term value rather than exit timing.

Therefore they typically acquire companies with sticky mission-critical software, high retention and strong lifetime value - assets where users are reluctant to churn and where future cash flows are more predictable and defendable. Global and regional consolidators such as Jonas Software and Vesta Software Group are already actively investing in CEE, closing transactions, while some others like Shop Circle or the Publix Group have recently put this part of Europe on their potential target list, but certainly more activity can be expected from this segment.

AI is hot, but both strategics and PE investors filter out AI “storytelling” and overclaiming. During our end-of-year discussions, investors confirmed to the Absolvo team that they are only interested in companies that have built and shipped real AI projects, with evidence of customer adoption and satisfaction. Especially those coming from the tech sector themselves, have been part of AI-related developments. As a strategic investor in ERP systems put it: “we see AI as evolution, not revolution”

At the same time, regulatory frameworks such as the EU AI Act, DMA and DSA are increasing scrutiny during due diligence. IP ownership, data governance, cybersecurity and compliance readiness have become core diligence topics, reinforcing the need for substance over hype.

In many cases AI investments are still driven by the FOMO affect, with nice engagement metrics, but unproven business models. Therefore, it is not for everyone. The above mentioned vertical software integrators have a specific view: as they are primarily looking for predictable recurring revenues, EBITDA-positive and preferably local / regional market leaders, they rarely engage with purely AI-driven businesses and will wait out until this niche is ready for consolidation.

However, AI is becoming a horizontal aspect of investments, too. Talking with global leading European PE firms like Permira or EQT, they all emphasized that in B2B software, “no AI thesis = no deal” is becoming the norm. As one of them put: “…anything we consider nowadays, there has to be an AI thesis around that”

4. CEE is an underexplored but increasingly attractive opportunity

Regarding tech deals, Central and Eastern Europe is playing its own role: as we have experienced in other parts of the world, the sector witnessed high-value deals in Q4 2024, led by strategic buyers focusing on digital growth, altogether there was a decline in deal volume, but a substantial increase (424%!!!) in value. Apart from the mega deals, mainly add-on acquisitions dominate. This is classic PE behaviour: using strong regional engineering talent and attractive price points to fuel platform growth.

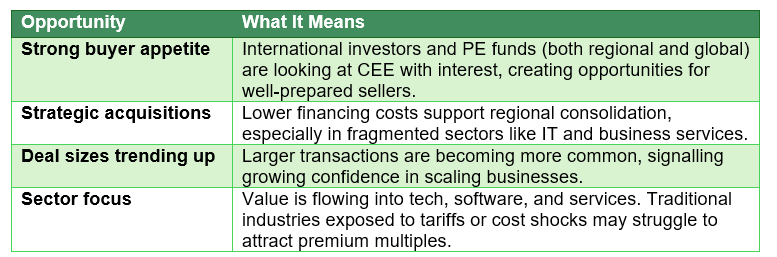

For many funds and strategics, CEE is turning into an underexplored opportunity rather than a “nice-to-have.” Some global strategic acquirers have repeatedly admitted to Absolvo that they historically overlooked the region - but rising valuations in Western Europe and the US are pushing them to broaden their horizon. “We know little about CEE, but we have recently turned toward the region.” said an M&A director of a major European B2B software developer company specialising in ERP, accounting and business management solutions.

If we look at specific verticals and buyers in niche segments like Palo Alto Networks or Encora in cyber security, their primary geo focus is elsewhere, mainly US and Western Europe. But if a certain technology fits their portfolio, let alone it is the missing piece or there is an interesting innovative element, they can be a relevant target. CEE is often perceived as a region of outstanding engineering and strong technology foundations - a compelling starting point, but rarely a deal thesis on its own.

The winning narrative builds on that base with a scalable product, proven execution, and/or a platform opportunity in a fragmented market, where consolidation is structurally embedded for companies that are born regional - or ideally born global.

5. How to prepare for 2026 (and beyond)

High importance on being strategic fit

During our end-of-the-year discussion with appr. 50 strategic investors and Private Equity firms, one of the key points were to identify how they look at a potential opportunity. What has been undoubtedly common in all strategic buyer talks was – no surprise - that strategic match is THE key!!!

This means business (sales, marketing) and product strategy alignment between buyers and sellers. Acquirers can have multiple motivations, from market expansion goals through diversification to cost savings - understanding this and clearly demonstrating how a target can accelerate those objectives is often one of the most decisive value drivers - in such cases, buyers are willing to pay even 2-3 times above fair market value.

Additionally, if a product can scale independently or integrate seamlessly into the acquirer’s portfolio, that flexibility means strategic value and opens up various post-acquisition scenarios. For exceptional CEE tech companies with great products and solutions, a larger strategic player with existing regional or global sales-marketing channels can be a real upside, opening endless opportunities.

As one M&A director put it:

“When strategic fit is clear and the product or talent is globally competitive, valuation becomes secondary - and geography irrelevant.”

In another discussions similarly, the hierarchy of criteria was revealed: Strategic synergies first; then strong management, good client base, scalability of the product / service – and valuation last.

Private Equity funds remain bullish - 2026 could be the breakout

Several major PE investors confirmed strong activity in 2025 and rising expectations for 2026. PE is gearing up for significant dealmaking - and CEE is more often on the consideration list. However, strong metrics and transparency are non-negotiable. For platform investments retention, gross margin, LTV/CAC, 30%+ growth - these are now the first filter, not the last. Regional VCs like Genesis, CEECat and European/global players like Hg Capital or Permira all emphasized the importance of strong marketing and go-to-market execution capabilities – a feature that is one of the key challenges of CEE-rooted scaleups.

For those planning an exit - or aiming to continue growing as a regional champion, potentially through inorganic expansion - 2026 may offer a particularly attractive window for transactions. Improving market conditions, active buyers and growing deployment pressure are creating promising opportunities. Regional VCs should evaluate their portfolios now: Which companies are strategically attractive? How prepared are their portfolio companies for a potential acquisition? Is exit preparation part of the overall strategy and is it in line with further product development plans? Optimization and preparation takes time, often 2-3 years, so it has to be started ASAP.

For those companies, where a transaction is still further out, this period provides valuable time to prepare. Exit readiness is rarely a short process; it often takes two to three years. Understanding your buyer universe within your sector, identifying potential strategic synergies, and embedding these insights into your long-term strategy can bring 2-3-5x of fair market value when the window opens.

All in all, if you plan a transaction in the next 2-3 years, you need to prepare ASAP. If you are interested in:

- how prepared you are for a strategic exit or a PE transaction?

- what are the fair multiples in your market?

- and how preparation can help you increase a potential exit value?

Feel free to reach out to the Absolvo Team for a consultation. We wish you clarity, discipline and momentum in the year ahead!

The analysis combines qualitative data coming from investor interviews conducted by Absolvo and industry benchmarks plus market data from sources including (but not limited to) PitchBook, Mergermarket, Sifted, Goldman Sachs, EY, Bain&Company, Deloitte and PwC.

.jpg)

What’s Driving the Rise of European M&A in 2025? Outlook and Opportunities for CEE Founders & Investors

Global slowdown, but Europe challenges the trend

H1 2025 saw a 9% global drop in deal volumes, even as deal values surged by 15%, driven by bigger, high-conviction transactions. Europe, however, is challenging that global trend – based on Pitchbook data:

- 10,274 M&A deals totalling over $516 billion were completed—marking the highest deal count in more than a decade.

- Q2 alone saw $256.3 billion in deal value and 5,205 transactions, underlining sustained momentum.

Meanwhile, Pitchbook also reported that Europe led the globe in private equity exits during H1 2025, surpassing North America in deal count.

What is driving deal activity in Europe?

Several factors explain Europe’s resilience in H1 2025 and support a positive outlook for H2:

- Valuation gap vs. US.: European companies are still priced lower than US peers, which draw interest from strategic and PE buyers.

- Financing advantage: The ECB cut rates twice this year, while the US Federal Reserve kept steady. Lower financing costs support both dealmaking and valuations.

- Sector focus: Tech, IT services, and software continue to attract the most activity, while energy, automotive, and chemicals remain under pressure from tariffs and higher input costs.

- Sustained appetite from non-European acquirers: PitchBook data shows that despite softer volumes in recent years (compared to a big boom in 2021-22), overseas buyers continue to deploy significant capital into European targets, with $114.9B already recorded in 2025.

Snapshot of CEE: Strategic opportunity and confidence

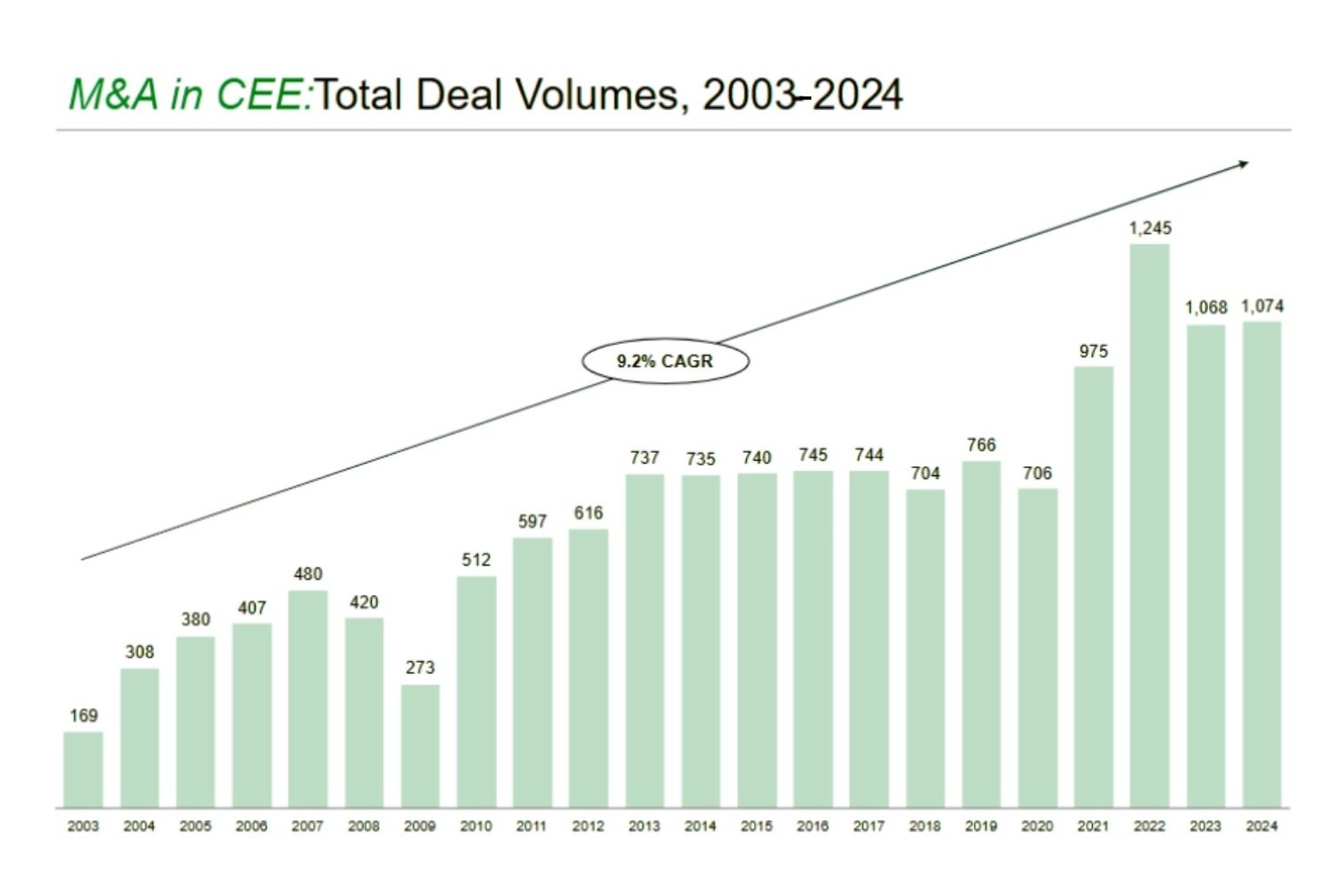

Looking back to the M&A history of the region, MergerMarket analysis shows a strong upward trend in deal volumes across the CEE region since 2003, growing from 169 deals in 2003 to 1,074 in 2024. It represents a 9.2% compound annual growth rate (CAGR). After a peak in 2021 (1,245 deals), volumes slightly declined but have stabilized above 1,000 deals annually in the past three years, signalling sustained transactional activity in the region that seems to be progressing in 2025.

Coming back to 2025, CEE continued to remain stable on sell-side activities, while buy-side transactions went up 3% in the beginning of 2025, according to Dealsuite. In comparison, the UK & Ireland (+8%) and the Netherlands (+6%) saw stronger buy-side momentum, while DACH (–3%) and France (–6%) experienced declines.

H1 2025 already saw notable CEE tech transactions, such as the acquisition of Poland’s Dealavo. EY also reported that while deal count in the region slowed, deal values jumped by 113% YoY, with mid- to large-scale tech transactions doubling. This shows CEE is no longer just a talent hub – it’s delivering real exit opportunities.

Across these deals, three patterns stand out:

- Exit timing: founders sold after proving €10–20M ARR, before heavy international expansion costs kicked in.

- Strategic logic: Western buyers used CEE acquisitions to add tech modules or engineering capacity faster and cheaper than building in-house.

- Fund dynamics: regional VCs raising new funds pushed for realizations, driving proactive sale processes.

Sector-wise, CEE follows broader European patterns:

- Business services and industrials lead in transaction volume.

- Software and IT services are particularly attractive thanks to strong talent pools and digitisation trends.

- Traditional sectors like automotive and construction remain active but face global trade and cost pressures

What does this mean for founders and investors active in CEE?

For founders, this means waiting for the “perfect moment” risks missing the buyer’s window. For investors, it underlines that CEE scale-ups are now proven exit stories, with buyers actively scanning the region. Preparation – in governance, metrics, and buyer relationships – will determine who captures premium multiples in the next wave.

Outlook for H2 2025: Optimism with cautiousness

Looking ahead to the second half of 2025, these are what we can expect:

- Deal flow is expected to stay strong, particularly in tech, infrastructure and services.

- More private equity funds may sell their portfolio companies in H2, as they look to return capital to investors and take advantage of active buyer interest

- Regional consolidation and possible megadeals will likely remain part of the picture, even as many founders continue to wait for the “perfect timing” to sell.

- Uncertainty remains, with tariffs, geopolitical risks and long-term rates still weighing on confidence. Yet, as PwC notes, “uncertainty may be the new constant”, and dealmakers who prepare strategically will outperform.

Summary

H1 2025 proved that European M&A is resilient, with deal flow at decade-high levels. For CEE, rising buy-side demand and steady valuations mean that both founders and investors have a real window of opportunity in H2. Let’s see at the end of the year how it turns out.

How Absolvo can support you in your M&A strategies?

At Absolvo, we know that preparation and the right partner can make or break a deal. Our experience shows that founders who prepare well in advance (often 2–3 years before a potential exit) and strategically position their business while accessing the right investors can achieve 2-3x better valuations and receive more competitive offers. With decades of M&A experience and a network of 28,600+ active investors, Absolvo help you navigate these times with confidence, because now may be the best time to act.

Reach out if you want to talk to us and prepare together for mastering your M&A strategy and exit opportunities.

Sources:

Pitchbook Report 2025

Mergermarket Report 2025

PwC Report 2025

Dealsuite Report 2025

M&A Trends in Central and Eastern Europe: What Recent Tech Acquisitions Reveal from 2025 H1

Pattern #1: Private Equity Fuels Strategic Expansion in CEE Tech

PE-backed multi-strategy execution

Like in a recent deal, where Hg is supporting JTL in advancing its SaaS product development while also enabling the company to expand regionally and into adjacent sectors, PE investors’ arekeen to find good targets. The acquisition of Dealavo is a prime example of these strategic objectives in action, just like Revolution Software’s by Seyfor, backed by Sandberg Capital and many more. This pattern is increasingly visible across the region; among our clients we see many CEE-based companies being approached by private equity-backed buyers.

PE backing fuels acquisition-led expansion

Since securing investment from Hg in Q4 2023, JTL-Software has completed five acquisitions - a notable shift from its previous track record of zero deals. With Hg’s capital and strategic support, JTL is aggressively growing its capabilities, market reach, and competitive position. Since Exadel partnered with Sun Capital Partners, the company has executed multiple acquisitions across Bulgaria and Poland. These moves expand its delivery footprint and align with a broader strategy to scale rapidly through inorganic growth

Takeaway

When a private equity firm backs up your potential buyer, it may be the right time to consider a transaction with them. PE involvement often signals future consolidation, strategic add-ons, and regional platform-building. Growth pressure and financing is given. We are directly involved in such transactions, often negotiating with private equity firms on the other side of the table. We’ve seen cases when a PE-backed company executed 25+ deals in 1,5 years, that highlights the pace and intensity of buy-and-build strategies once the capital and mandate are in place.

Pattern #2: Complementary Software Acquisitions Drive Product Innovation

Enhancing product offering

JTL strengthened its cloud-native multichannel suite by acquiring Dealavo’s advanced pricing and market intelligence solutions. This enhances JTL’s value proposition to existing clients and supports upselling within its ecosystem.

AI capabilities as a differentiator

Anthill, acquired by Exadel, brings significant expertise in data, AI, and enterprise software development. These capabilities align with Exadel’s strategy to deliver innovation-focused,high-value digital services.

Strategic fit

These buyers are increasingly focused on acquiring companies that complement their core platforms. By integrating specialized capabilities like pricing automation, data engineering,or cloud-native tools, acquirers can quickly expand their value offering. Simple as that: the buyer can offer additional features, modules or software to their existing client base almost immediately and start generating revenue (and profit) from day one.

Pattern #3: International Expansion Through CEE Tech Hubs

Global expansion through local leaders

Dealavo’s presence across 30+ markets supports JTL’s regional expansion goals, especially in the DACH region.

Cross-border scale

Savangard, acquired by Digia, already generated nearly 30% of its revenue outside Poland, helping Digia diversify risk and broaden its reach across Europe.

CEE as a delivery hub

With the acquisition of Anthill, Exadel makes Bulgaria its second-largest European delivery location. Buyers increasingly recognize CEE’s importance for nearshoring, talent access, and strategic delivery capacity.

These deals can illustrate a larger trend: once acquirers become active in the CEE region, they are more likely to pursue follow-on acquisitions due to growing familiarity with the legal and business environment.

Pattern #4: Smart Valuations in CEE Tech M&A Deals

Attractive pricing dynamics

Digia’s acquisition of Savangard at approximately 6.5x EBITDA reflects a disciplined yet strategic approach. This valuation is below the 8-12x EBITDA median typically observed in the regional IT services space.

Takeaway

High-quality targets that demonstrate growth, profitability, unique capabilities, visionary management and international reach continue to attract strong valuations, especially when they fit into larger strategic narratives.

Pattern #5: Retaining Local Talent and Brands in Regional Deals

Preserving team and identity

Savangard will continue tooperate as a subsidiary under Digia, retaining its leadership and brand (a model that supports client trust and post-deal stability).

Gradual integration

Anthill will initially operate as “Anthill by Exadel,” signaling respect for the company’s culture and relationships while ensuring alignment with the parent company’s global operations over time.

Takeaway

As per our experience, more and more acquirers – particularly in tech and innovation-driven sectors – are shifting away from fully integrating acquired teams to preserve innovation, retain talent and reduce cultural friction. Research also supports this trend,highlighting that light-touch integration and portfolio models help maintain agility and morale while enabling faster realization of value. Forcing integration can undermine the very qualities that made the target company attractive in the first place.

Pattern #6: Rise of the vertical software integrators

A new type of buyer is becoming increasingly active in CEE: vertical software integrators. These firms typically focus on a specific or narrow set of industries, and their goal is to build platforms of industry-focused software and services that can scale internationally. As global economic uncertainty led many strategic buyers to become more cautious in recent years, these specialized players have grown bolder. From the UK to Dubai, and from Germany to Poland, we're seeing more of these integrators actively exploring the region, engaging in deals and establishing a broader presence in CEE. We’ve seen this trend firsthand. Our team recently closed two transactions involving vertical software integrators, and we’re tracking several more in the pipeline.

Read more about the role of Software Consolidators in our detailed article on CEE-SaaS M&A.

Closing remarks

The Central and Eastern European technology M&A market is clearly evolving. International buyers - both private equity-backed and strategic - are actively acquiring regional companies to access talent, specialized capabilities, IP, and scalable platforms.

Successful targets often exhibit a combination of international client exposure, cloud or AI-enabledservices, globally tested products, and a strong niche focus. As more capital flows into the region and acquirers grow increasingly comfortable with local dynamics, we anticipate continued momentum in the CEE deal market.

About Absolvo

Absolvo specializes in M&A and growth financing, backed by 380+ completed deals collectively in the Central and Eastern European region. We support technology companies through strategic exits, private equity transactions, and cross-border growth initiatives. If you are considering an exit or a strategic partnership, our team is ready to help you prepare and position your business toward an exit that could deliver 3–5x its fair value.

Analyzed companies:

JTL Software - ERP-Software von JTL: Smarte Lösungen für den E-Commerce

Hg Capital - Hg | Building enduring software and services leaders | Hg

Dealavo - Competitor price tracking software & price analysis - Dealavo

Savangard - Homepage - Savangard

Anthill - Home - Anthill

Exadel - Enterprise Software Development and Consulting | Exadel

Digia - https://digia.com/

Sources:

Market Screener

Mergermarket

McKinsey Report 2022

PwC Report 2024

Channel E2E

Decoding CEE M&A: Key Insights into Tech M&A Trends in Central Eastern Europe from H2 2024

Pattern #1: B2B niche targets are attractive for vertical software firms

- Example to highlight:

Upliift, a London-based investor, focusing on European B2B software firms with revenues between €1-25 million acquired SRC, a Slovenian software development firm with over 200 employees and a presence across several countries in the CEE region.

- Pattern explained:

This transaction aligns with a recent trends in the region, where a new class of investors such as Vesta Software Group, Everfield, saas.group, Jonas Software or Constellation (and many more) target cashflow-positive, founder-owned B2B software companies in niche markets. Unlike traditional strategic buyers, these investors prioritize maintaining the independence of acquired companies, fostering growth without full integration.

Pattern #2: Prior partnership with acquirer increases the chances of transaction success

- Example to highlight:

The recent acquisition of Polish companies Mediarecovery and SafeSqr by Dutch firm DataExpert, which was rooted in over a decade of increasingly close cooperation between the two entities. DataExpert has employed a similar strategy in the past, collaborating with Swedish Forensic Experts Scandinavia AB before acquiring them in 2018.

- Pattern explained:

When acquisitions stem from years of cooperation, buyers gain a deep understanding of the target's strengths, values, and potential revenue impact. This prior collaboration can also benefit the target by justifying a higher purchase price, often supported by proven results.

Pattern #3: Private Equity fuels inorganic growth

- Example to highlight:

Software Mind, a Polish software development services provider, backed by Enterprise Investors – one of the largest Private Equity funds in Poland and the CEE region, acquired Gama Software, a software development company based in Romania.

- Pattern explained:

The involvement of PE firms is a key driver of M&A activity in CEE. Companies backed by PE often pursue aggressive buy-and-build strategies to scale and expand. As a result, these companies tend to engage in more acquisitions than their non-PE-backed counterparts, as growth is a key expectation from private equity investors.

Pattern #4: Consolidation is the good old strategy for growth

- Example to highlight:

Bianor Holding’s acquisition of Prime Holding and Digital Lights in Bulgaria demonstrates a strategic move to consolidate capabilities and strengthen competitive positioning in the industry.

- Pattern explained:

Consolidation is a powerful strategy for everyone, in this case, for IT service providers in the CEE region seeking to compete on European and global stages. To effectively challenge larger players in other markets, these companies must increase their size by pooling resources and expertise, allowing for faster scaling. As some CEE firms strive to penetrate these larger markets, size and operational capacity become crucial factors for success.

Pattern #5: Timing can make or break a deal

- Example to highlight:

Moj-eRačun, Croatia's leading provider of SaaS business tools, specializes in digitizing administrative tasks with its flagship product that offers e-invoicing and document management solutions. This product seamlessly integrates with over 400 ERP systems, providing a substantial competitive advantage as Croatia prepares for mandatory B2B invoicing set to be implemented in 2025.

- Pattern explained:

Timing significantly impacts deal success, especially in markets preparing for regulatory shifts. This upcoming regulation is anticipated to drive demand, adding competitive value. The favourable timing and anticipated revenue growth contributed to a noteworthy valuation in the acquisition by Visma, a Norway-based software provider with an existing track record in the region.

Summary

From niche B2B acquisitions to strategic timing, these insights reveal the diverse approaches shaping tech M&A in the CEE region. Understanding these patterns can be crucial for investors and companies alike, as they navigate the unique dynamics of Central Eastern Europe’s evolving tech landscape.

At Absolvo Consulting, we are actively managing transactions for tech and innovation-driven companies across Central and Eastern Europe. Our daily interactions with strategic buyers and private equity firms give us unique insights into investor priorities, emerging investment trends and market dynamics. This helps us gain a precise understanding of investor needs and focus areas, so we can tailor our deal strategies for our client’s projects to meet these specific requirements.